An invoice is a binding legal document between your business and your customers. Read on to know all the important information it must contain.

Entrepreneurs spend hours on end working on their product ideas, execution processes and marketing strategies. But how much thought does anybody put in when it comes to their invoices? True that the need for an invoice arises only after a client makes a purchase, but why not consider it as the last step involved in making a sale and not merely as a practice that has to be followed? A perfect invoice conveys the message that your business is immaculate, and that you are committed to perfection until the very end. So, here is a list of all the important things to include while creating the perfect invoices for your business.

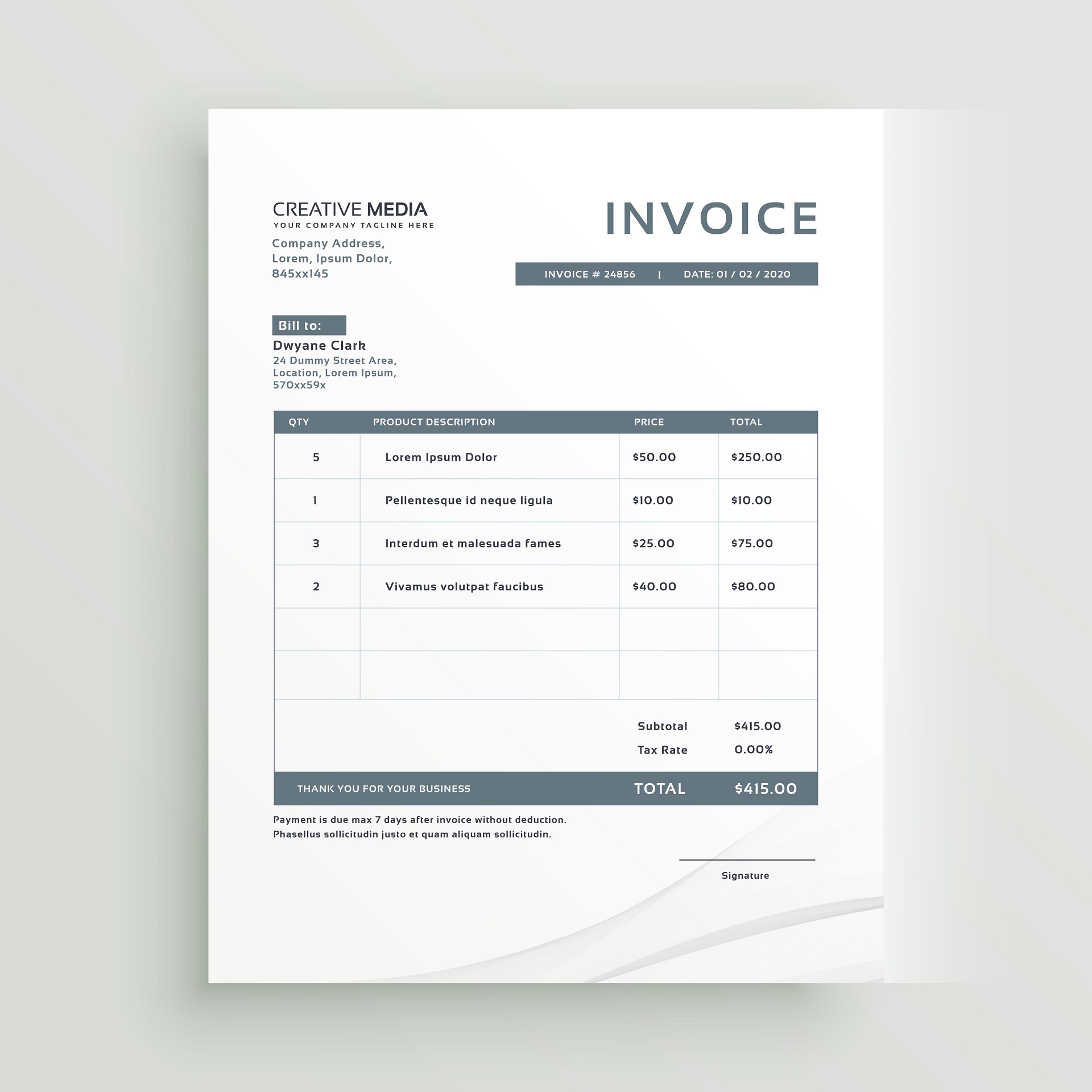

The word ‘Invoice’: Have the word ‘Invoice’ on the top of the page so that your customers instantly know what it is. The chances of it getting buried among receipts and other documents are high, so having the word in bold letters help to make sure that it gets noticed and therefore, that you get paid.

Invoice number/reference: The invoice number that you generate must be unique to a particular invoice. You can structure it any way you want—alphabetic, numeric, alphanumeric, or it can even begin with the first couple of letters of the name of the person/company you are invoicing it to.

Company information: Adding the company’s legal name and business address is a practice followed by almost everybody. However, that’s not enough. Let’s assume that your client receives the invoice and is in need of a quick clarification regarding the purchase. What are they expected to do? Look up your business phone number on the internet or search for it on your website and then call? To make things easy for your customers, include your company’s contact number and email address on the invoice along with the address. Also include the company name and address of the customer. To differentiate between the payer and the payee, add the label ‘Billed To’ before the payee’s name and address.

Date and payment terms: Although the date alone would give your customer sufficient information regarding when the invoice is due, it is advised to state clearly when the grace period for payment ends.

Line items, quantity, description and price: This is important, especially if the customer makes multiple purchases. By having it on your invoice, you help your customer understand the breakdown of the products or services and the taxes involved so that they know exactly how much they spend on what.

Purchase Order Number: Every product company needs to keep track of its inventory, co-ordinate sales, and balance shipments and purchases. Having the Purchase Order Number in the invoice helps you track the purchase better.

Total amount: The total amount due should be the easiest thing for your customer’s eyes to notice about an invoice. If there is any ambiguity surrounding this amount, your payment could get delayed.

Modes of payment: Mention the payment methods you accept so that you don’t leave your customer wondering whether he must write you a cheque or make an online transfer.

Tax ID: Make sure you also include your company’s tax ID – depending on which part of the world you are registered at. In the case of Indian businesses, this would be your GST number.

Although these are the customary items that must be included in an invoice, you can make yours even better by making it more unique. Including additional information about new product/service launches, your company’s return and exchange policy, discounts or even a ‘thank-you’ note under the label ‘Notes’ at the very bottom can go a long way in helping customers remember your brand. Ideally, get an expert opinion from an accountant as well, especially regarding taxes and other government rules that may vary from region to region. Remember that your invoice is a medium through which you can leave a lasting impression on your clients, thereby increasing your chances of further growth through word-of-mouth as well as referrals. It is a good practice, and a necessary investment for your growing business.